A Study Shows How Amazon Air is ‘Quietly’ Expanding The Company’s Logistics Network to Rival UPS and FedEx

Is Amazon a logistics company or an online retailer? The answer to that question seems to get more difficult as the company continues to expand its logistics network globally.

Many people have seen a local Amazon-branded delivery vehicle in their neighborhood or on the road. And there has been no shortage of announcements with local officials gushing over Amazon opening new fulfillment centers in their areas, often touting the job growth these centers bring. Nevermind the fact that Amazon continues to improve and invest in automation and robotics and the number of workers required to run a center today is far less than five years ago, a trend likely to continue.

But the “quiet” growth by Amazon maybe its air network, Amazon Air.

From time to time, Amazon has announced new airports and planes, but the scale and growth of the network really are not as visible unless one takes a much closer look, which a report issued Tuesday by DePaul University’s Chaddick Institute for Metropolitan Development did.

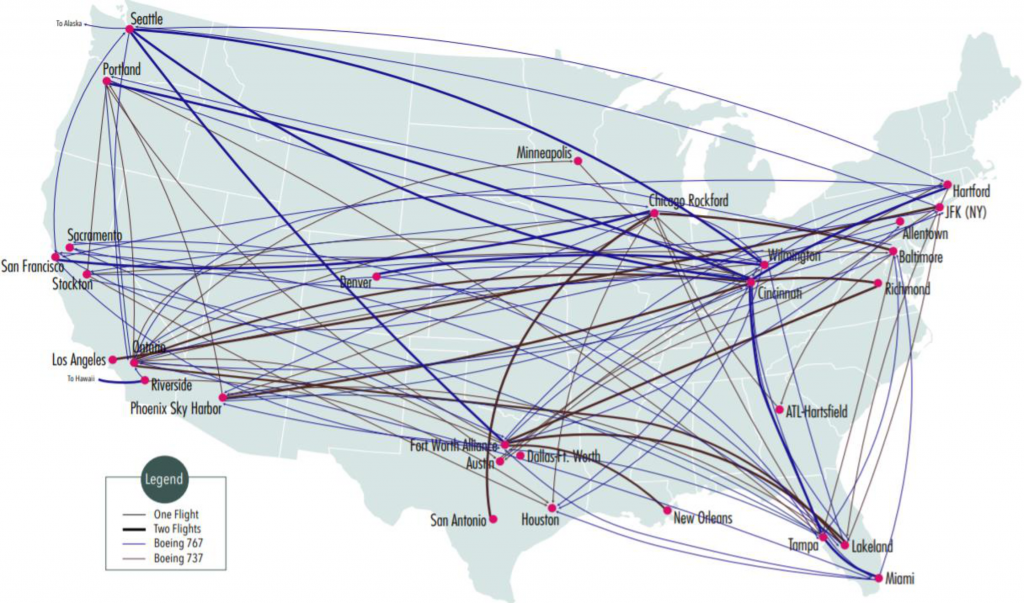

Currently, Amazon Air flies on average 140 daily flights in the U.S., which the reports suggest will increase to 160 flights in June. That would approximately double the number of flights the company operated about a year ago.

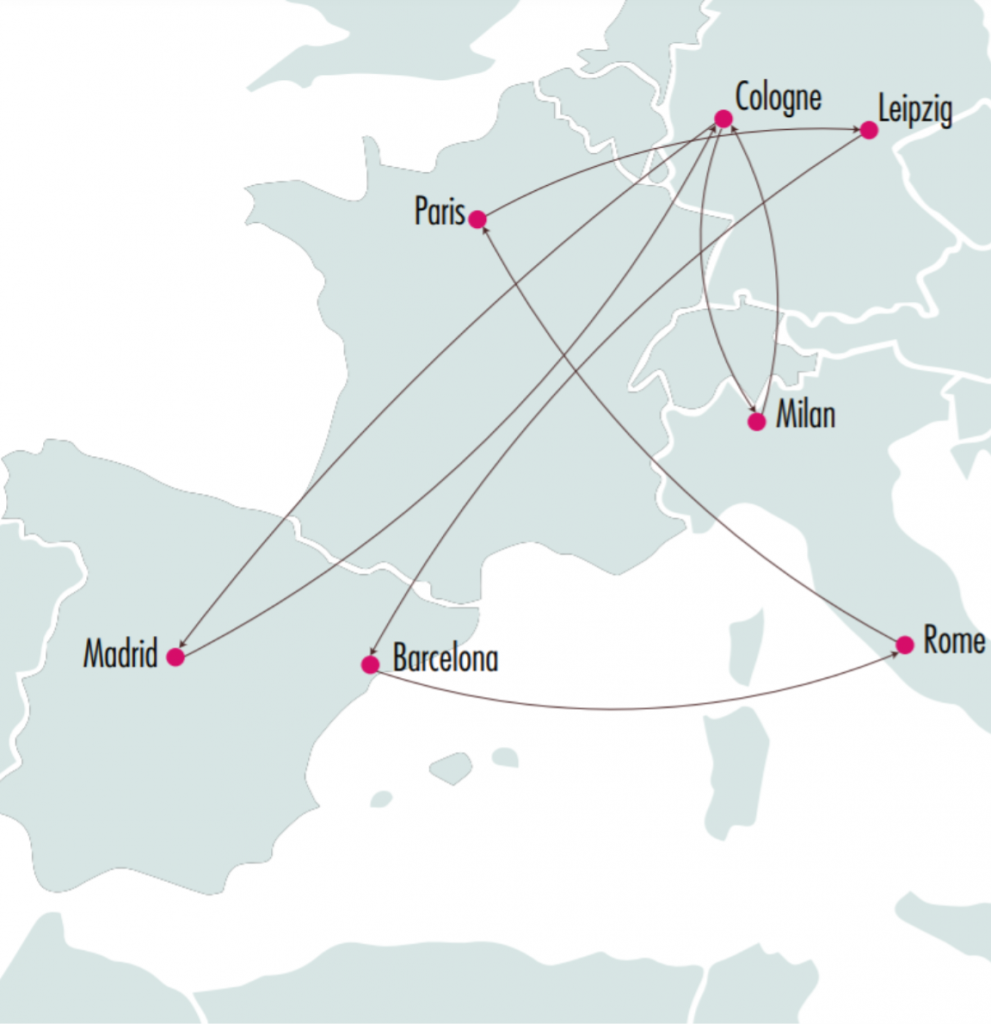

But it is not just expanding its operations in the U.S., it also has added planes and flights in Europe now serving four countries, Germany, France, Italy, and Spain. In comparison to the U.S., the European network is in its infancy.

Amazon already announced that Leipzig will serve as its European air hub as it continues to expand air operations in Europe. The choice of Leipzig, Germany is significant because Amazon also uses the Cincinnati/Northern Kentucky International Airport as its primary hub for the U.S., meaning two of three DHL Global Hub cities are also primary Amazon Air hubs. Hong Kong is the third DHL Global Hub, but Amazon Air has no APAC operations (yet).

The report suggests Amazon may also consider Cologne as a European hub as it is the second-largest air hub in the global UPS network, but that appears unlikely considering Amazon’s announcement about Leipzig.

This suggestion appears based on current Amazon Air flight operations being larger at Cologne versus Leipzig. However, considering the skeleton nature of the European network and the primary U.S. Amazon Air hub being a DHL Global Hub too, the more frequent air operations at Cologne today appear to be a temporary anomaly.

Amazon Air U.S. Domestic Operations

While Amazon Air’s international and intercontinental operations are still in their infancy and rife to much speculation, the U.S. domestic route network is much clearer and defined. Amazon has also supported its air operations with nearby fulfillment centers located close to regional hubs and destination airports Amazon Air serves.

Even as Amazon continues to invest and expand its trucking operations, primarily through the use of independent trucking companies and entrepreneurs, Amazon Air is a major piece of the U.S. logistics strategy as the online retailer aims to bring more next-day deliveries to more addresses across the U.S. There is no turning back now to offer slower delivery when Amazon customers (and online shoppers in general) have become accustomed to fast and free delivery.

Amazon Air’s operating and announced fleet of 85 planes by 2022 is still small by comparison to FedEx (679 planes) and UPS (572 planes). But unlike those logistics companies, Amazon is first and foremost establishing a logistics network to handle its own fulfillment and retail operations.

There is some speculation that Amazon may become a logistics rival to UPS and FedEx by offering its services to independent online retailers and other non-Amazon sellers. The report suggests that could happen in under 18 months, but even with the growth rate by Amazon logistics, land and air, that seems like a very aggressive timeline.

However, one should never underestimate Amazon and there are plenty of planes sitting in deserts that could be converted to freighters. The last 11 announced aircraft additions to Amazon Air’s fleet were previous passenger planes operated by Delta and WestJet. The anticipated fleet size of 85 planes by 2022 could easily grow into triple digits sooner than later.

For now, Amazon is still an online retailer and cloud computing provider (AWS). But over time, this could change as more aircraft, more trucks, more warehouses, and more delivery vehicles are becoming part of the rapidly growing Amazon logistics network.

Here is the link to the report on Amazon Air by DePaul University’s Chaddick Institute for Metropolitan Development.

If you liked this article and would like to engage with other small business entrepreneurs selling on marketplaces, join our [the_ad id=”41560″ inline =”1″]. You can also find us on [the_ad id=”41579″ inline =”1″], [the_ad id=”41573″ inline =”1″], [the_ad id=”41575″ inline =”1″], and [the_ad id=”41577″ inline =”1″] or sign up for our newsletter below.

SIGN UP. BE INSPIRED. GROW YOUR BUSINESS.

We do not sell your information. You can unsubscribe at any time.

Richard Meldner

Richard is co-founder of eSeller365. He has over 17 years of experience on eBay which includes tens of thousands of sales to buyers in over 100 countries and even has experience with eBay’s VeRO program enforcing intellectual property rights for a former employer. And for about two years Richard sold products on Amazon using Amazon FBA in the US.

To “relax” from the daily business grind, for a few weekends a year, he also works for IMSA as a professional race official.