Impact of U.S. Sales Tax Decision on International Sellers

Note: Please read disclaimer section at bottom of this article!

Last week the Supreme Court of The United States issues an opinion on a case involving when online sellers must collect sales tax.

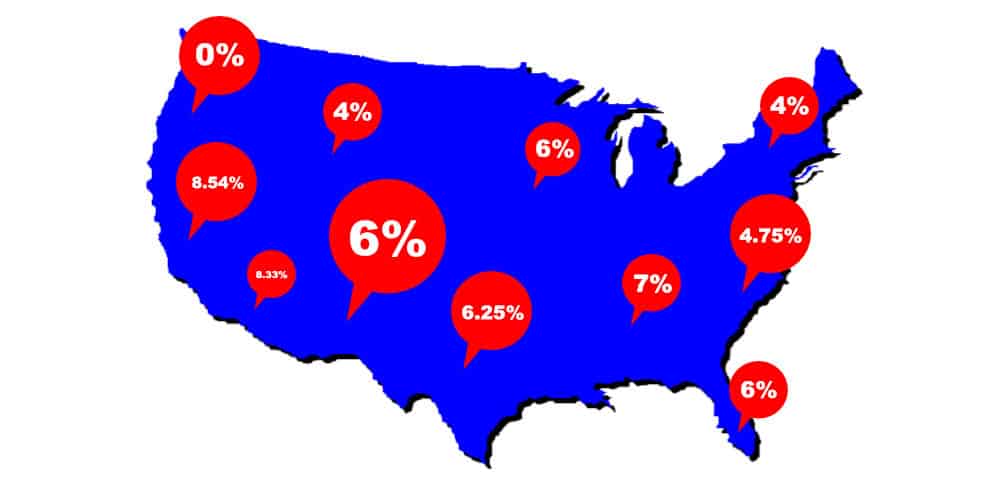

In quick review. Sales Tax in the U.S. is managed by states, not on the federal level. So each state can set its own sales tax requirement and within the states, there can be local tax jurisdictions such as counties, cities, or tax zones that may impose additional sales taxes.

There are over 10,000 of such tax jurisdictions, but all the tax jurisdictions are collected at the state level. Meaning sellers really do only deal with up to 51 (50 states plus District of Columbia) sales tax collection agencies.

Four states, Delaware, Montana, New Hampshire, and Oregon, do not have any sales tax, state and local. Alaska has no state-level sales tax but has some local level state taxes.

READ MORE: Supreme Court Decision on Sales Tax – But What Does It Mean?

What Changed?

The opinion issued by the Court overruled two previous opinions by the Court that requires sellers to have a physical presence in a state before sellers would be required to collect sales tax.

So, unless a retailer had an office, warehouse, or any staff in a state, the state could not force the retailer to collect sales tax. That is why so many small businesses only collected sales tax in their home states and never outside of their states.

Now, the court reversed its own position and said that other means to determine when sales tax collection is required may be used by the states.

It is important to note, it did not say volume is the only factor for determining NEXUS, the minimal requirement on when sales tax collection is required.

It only said other means are allowable and therefore all physical location requirements did not become invalidated. They still apply and this important in regards to two states that enacted Marketplace Facilitators laws.

Confused Yet?

So let’s take a look at what this ruling changes for international online sellers.

Shipments Originating From Outside the U.S. from an International Seller

Online Store Location/Warehouse: Outside US

Shipment Origin: Outside US

Shipment Destination: U.S. address

The vast majority of international sellers will fall into this category. They operate a store in their country and are shipping products from their county to a customer in the U.S.

Standard cross-border import taxes and procedures apply. There is no state-level requirement that may apply to the seller located outside the U.S.

Any importation taxes that may come due from sending a product have to be paid for by the recipient at the time of delivery.

USPS (Mail), UPS, FedEx, DHL operate their own brokerage services and will manage the importation of the product and deal with any tax issues directly with the recipient.

If you are using another carrier for shipping to the U.S., you should contact them to make sure they handle the brokerage services. But that has nothing to do with sales tax, that is standard procedure for sending products to the U.S.

Bottom Line – No change to sellers that fall into this category

This information applies to:

- Sales from your own website.

- Sales from pure marketplace such as eBay and Etsy.

- Sales from seller fulfilled shipments on Amazon’s Third-Party Marketplace (Amazon FBM) in any country but the U.S.

- Sales from Amazon FBA merchants located in a non-U.S. country from a non-U.S. Amazon warehouse should also fall into this category. But Amazon may impose internal policies to such shipments and that may change from country to country, so it is important to always stay informed with Amazon FBA policies for cross-border trade.

READ MORE: Supreme Court Decision on Sales Tax – But What Does It Mean?

Shipments Originating From Inside the U.S. from an International Seller

Online Store Location/Warehouse: Outside US

Shipment Origin: Inside US

Shipment Destination: U.S. address

NOTE: This section applies Amazon FBA shipments as well. But there are additional factors with Amazon FBA. So please read this section, but then the following section specific to Amazon FBA.

A small set of international sellers may fall into this category.

If an international seller uses fulfillment services from carriers such as UPS, FedEx, DHL, fulfillment services such as Selery, and Amazon FBA (read next section as well), then the new laws enacted by states to enforce sales tax collection may apply.

The Court did not set a minimum threshold or provide any specific instructions when sales tax collection is required.

In its opinion, the Court can only look at existing laws and provide an opinion if they fall within the boundaries of the U.S. constitution.

Only the U.S. Congress can enact laws that would apply to all states, thereby creating one minimal threshold for all sellers. While there have been several attempts at this previously, it hasn’t happened and it is unclear if Congress will act.

However, the Court was extremely concerned the impact on small businesses and effectively is trying to nudge Congress to act and also used the example of South Dakota’s sales tax law as a de facto acceptable minimum standard.

But in theory, every state can set its own standards, but it would seem that may not be very wise unless that state wants to litigate their standard in front of the Supreme Court.

For that reason, there is a belief that many states will initially follow South Dakota’s law, which requires an annual minimum of $100,000 in sales or 200 individual transactions to residents of the state before sales tax collection is required.

International seller may want to contact their fulfillment service in the U.S. and discuss this change in sales tax.

Some services may get into offering sales tax help, while others may stay away from this completely in which case a third-party service such as Avalara or TaxJar may become necessary.

In the short term, if your sales are well below $100,000 or 200 transactions per year, there really isn’t a change.

Bottom Line – Most sellers won’t need to do anything unless they have significant sales in the U.S. through this method.

This information applies to:

- Sales from your own website.

- Sales from pure marketplace such as eBay and Etsy.

- Sales from most US-based Amazon FBA shipments. (see section below).

- Sales from any Amazon Third-Party Marketplace (U.S. or International).

Sales from US-based Amazon FBA

Online Store Location/Warehouse: Outside US

Shipment Origin: US-based Amazon FBA

Shipment Destination: U.S. address

NOTE: Amazon FBA sellers – please make sure you read the previous section.

International sellers that use US-based Amazon FBA will be faced with two distinct situations.

Amazon FBA shipments to U.S. customers NOT going to addresses located in Washington State and Pennsylvania currently fall under the same rules as the previous section on shipments originating from fulfillment centers located in the U.S.

But, for shipments to Washington State and Pennsylvania, under state laws enacted by those two states, Amazon is responsible for collecting sales tax.

The two states added provisions to their sales tax laws that make marketplaces with physical locations in the state responsible to collect the sales tax from third-party merchant sales.

The laws have been called “Marketplace Facilitators” laws and see the section below for more details about them.

It makes no difference to these two states if the merchant is a U.S. merchant or an international merchant.

If the item was fulfilled through Amazon FBA, Amazon must collect, report, and submit the sales tax to the state.

This information applies to:

- Sales shipped from US-based Amazon FBA.

- Sales made through US-based Amazon Third-Party Marketplace but fulfilled by another fulfillment service. Amazon FBM.

READ MORE: Supreme Court Decision on Sales Tax – But What Does It Mean?

Marketplace Facilitator Sales Tax Laws

As mentioned in the previous section, prior to the Court overturning its own opinions and no longer making the physical location the NEXUS test on when states can enforce sales tax collection, two states chose to tie marketplaces with physical locations in their state to requiring them to collect sales tax form sellers.

US-based Amazon FBA sales were definitely impacted by those Marketplace Facilitator laws and Amazon started collecting sales tax on those shipments, regardless if the merchant’s legal address was based in the U.S. or in another country.

Etsy enacted collection of sales tax in Washington State and Pennsylvania, but it appears from its language, this may have only applied to U.S. and Canadian sellers.

What is intriguing about the Etsy situation is that there are no known physical locations by Etsy in those states.

So the company apparently chose to follow these laws proactively. Presumably assuming physical location was under review by the Supreme Court and likely to be overturned.

We are not aware of either Amazon or Etsy collecting sales tax for shipments to these two states from sellers that are located outside the U.S. and ship from outside the U.S.

The wording of the two Marketplace Facilitator laws would suggest that technically they should be collecting sales tax. We are trying to get some clarity on this from both companies.

But we assume one likely reason they may not have been collecting sales tax from international sellers shipping to customers in Washington State and Pennsylvania is that international seller listings usually originate on legal entities owned by the two U.S. corporations outside the United States.

To date, we believe only Amazon and Etsy are following Marketplace Facilitator regulations in those two states.

But with the freedom that states gained from the U.S. Supreme Court decision, it is likely that more states may enact Marketplace Facilitator sales tax collection laws.

In a roundabout way that may be good news for marketplace sellers as this would place the burden of collecting, reporting, and submitting sales tax to the marketplaces and leave sellers to worry about listing and selling, instead of a myriad of sales tax regulations.

Obviously, the downside could be that marketplaces will end up trying to recoup costs involved with such increases compliance if more Marketplace Facilitator laws are passed and will eventually pass those costs on to sellers in the form of fee increases.

Retroactive Enforcement

One topic of concern from all sellers is the ability of states to attempt to apply retroactive enforcement on laws they may have enacted but did not fully enforce until the State had clarity from the Supreme Court.

The Court seemed pretty happy with South Dakota’s law that specifically prohibited retroactive enforcement until the constitutional question was resolved.

But that does not mean that other similar laws by other states had such language. However, it would seem foolish for a state to not give small businesses an opportunity to comply with sales tax laws, including avoiding retroactive enforcement.

It would seem that could land a state in front of the Supreme Court to force a decision that on the surface appears to be of great concern of all the justices. Why take that risk?

The states kind of won this round. But unless the states follow South Dakota’s law, they may end up getting Congress involved quicker or find another case making its way to the Court that could provide result in more limitations.

Congress

As we have stated numerous times, under U.S. law, Congress can enact laws that could create a single standard for all states to follow.

Under the U.S. constitution, The Federal Government has regulatory control on interstate commerce and could pass any law it wants to establish its own NEXUS standard, including going back to using physical location.

In this case, a federal law would supersede the U.S. Supreme Court decision because the constitution explicitly provides Congress this power in interstate commerce.

READ MORE: Supreme Court Decision on Sales Tax – But What Does It Mean?

What About a VAT, National Sales Tax, of GST-style Tax?

Theoretically possible. Politically, highly unlikely even if the Congress would change and become less conservative during this November’s election cycle.

There is no established federal agency to deal with such sales revenue based collection of taxes on the federal level. The federal government would be starting from ground zero.

And the complexity of establishing such an agency and then trying to sort out a scheme how often such money is collected, which sales would be excluded, and how this money is distributed back to the states would take years to resolve.

Finally, it would very likely require a President willing to sign such a law into force, another major hurdle in this process and one that could only be overcome with a super majority by one party in Congress. Something that very rarely exists in the U.S.

Getting Help

Without a doubt, there is a lot of “chaos” right now in the U.S. around Sales Tax.

Actually, U.S. sellers find themselves in even further uncharted waters because some states have laws on the books, but they did not enforce them yet as they were awaiting the Court’s decision.

So here are a few places you can go to get more information.

- Online Merchants Guild – A trade association that represents small online business on a variety of topics but sales tax is the hot button topic right now and they have been actively involved.

- Avalara – A fee-based service that works with U.S. and international sellers to collect, report and submit sales tax.

- TaxJar – A fee-based service that works with U.S. and international sellers to collect, report and submit sales tax.

Disclaimer

This article is guidance only, it does not represent a legal opinion or provide legal guidance. We have done our best to include most common circumstances in our examples, but depending on the legal status of our company or your legal arrangement with US-domiciled entities that act on your behalf, there could be significant legal differences and regulations you may have to follow. Also, the information is believed to be accurate to the best of our interpretation of the laws and the opinions provided by the Supreme Court of The United States as of the last update of this post (see date below).

It is important to understand that the Supreme Court of The United States provides opinions. The word decision is often used by the media when reporting on the Court, but it the actual process by which the Court makes a “decision” is through opinion.

In the U.S., an opinion by the Supreme Court of The United States is legally binding until the court offers another opinion on the same or similar matter. But an opinion is NOT LAW, as the Supreme Court of The United States does not write laws, only interprets them for legal enforcement.

Last Update June 24, 2018

We’d love your Opinion on this article (the pun fully intended). Head over to our Facebook Discussion Group or use the comments section below.

If you liked this article and would like to engage with other small business entrepreneurs selling on marketplaces, join our [the_ad id=”41560″ inline =”1″]. You can also find us on [the_ad id=”41579″ inline =”1″], [the_ad id=”41573″ inline =”1″], [the_ad id=”41575″ inline =”1″], and [the_ad id=”41577″ inline =”1″] or sign up for our newsletter below.

SIGN UP. BE INSPIRED. GROW YOUR BUSINESS.

We do not sell your information. You can unsubscribe at any time.

Richard Meldner

Richard is co-founder of eSeller365. He has over 17 years of experience on eBay which includes tens of thousands of sales to buyers in over 100 countries and even has experience with eBay’s VeRO program enforcing intellectual property rights for a former employer. And for about two years Richard sold products on Amazon using Amazon FBA in the US.

To “relax” from the daily business grind, for a few weekends a year, he also works for IMSA as a professional race official.

Do I understand you correctly in one example given above that an international seller, selling not through a marketplace but rather through their own website with inventory held in a US location (so has physical nexus as I understand it) is unlikely to need to collect sales tax unless retail sales in the state where they have that physical nexus through their inventory storage and fulfilment exceed $100,000 or 199 transactions in any given year?

Actually reading this article again, Situation 2 above where the shipment origin is within the USA through a fulfillment company for an international seller implies that although a sale is fulfilled with stock from a US location it does not automatically indicate that there is a physical nexus in that location which would require sales tax to be charged in that state. So if the sale is made through the international seller’s own website then the remote seller situation would apply and when economic nexus is reached in any state that is when sales tax would be due? Would really appreciate some clarification as I’m getting myself muddled the more I read.