eBay, Etsy and Other Marketplaces on Brink of Having to Disclose Seller Details with INFORM Act ‘Hidden’ in 4,000+ Pages Federal Spending Bill Before Congress – Update

The big $1.7 trillion federal government spending package in front of Congress this week also includes the INFORM Consumers Act (INFORM ACT), a change that will affect sellers on online marketplaces like eBay and Etsy.

Update 12/29: The government spending bill was signed into law by President Biden on December 29 and it includes the INFORM Act as described below. None of the last-minute 1099-K amendments made it into the legislation, but the IRS delayed the implementation of the $600 threshold by one year.

If passed, the provisions of the INFORM Act would require marketplaces to disclose business seller information in the clear on each listing as well as require them to collect additional personal information in some situations.

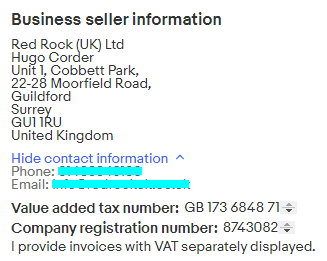

Other countries, such as the UK, already require this type of seller transparency as in this example from a business listing on eBay UK (we obscured phone and email for privacy).

The INFORM Act has been controversial from the beginning, with Big Box retailers making it more difficult for small marketplace sellers to launch businesses online.

In May of 2021, eBay said: “Over the last 12 months, Big Box retailers have launched a coordinated effort at the State and Federal levels to make it more difficult for small businesses and entrepreneurs to sell goods through online marketplaces.”

“The INFORM Consumers Act is pushed by proponents as an effort to ‘improve transparency in the online buying process.'”

In its original form, the legislation would have required marketplaces to verify each seller’s identity, similar to how financial institutions follow Know Your Customer (KYC) regulations, requiring sellers to provide a driver’s license and other personal information.

In addition, marketplaces would have to disclose a business seller’s full name, address, phone number, and email address, only allowing for some limited protections for home-based businesses.

Both eBay and Etsy were vocal in opposing this legislation on privacy and security ground. While fair enough, we also believed in 2021, the motives by both marketplaces were also to keep shoppers from directly contacting sellers to circumvent selling fees.

Changes to INFORM Act Language

Earlier this year, eBay provided an update on changes to the INFORM that supposedly make it more palatable for online marketplaces and changed its tune in supporting the legislation now.

“The new version of INFORM increases transparency, protects sellers’ privacy, and will provide one federal compliance standard for online sellers,” the company said.

“eBay supports the federal INFORM legislation,” and the company also claimed the “compromise bill language has broad support across industry stakeholders and consumer groups.”

It’s been quiet on the INFORM Act front since eBay’s last update, but that has changed now.

INFORM Act In 2023 Spending Bill

In the spending bill released yesterday, which will likely be passed this week to keep the government running in 2023, the INFORM Act is included on page 2800, spanning 20 pages of the 4,155-page appropriations bill.

No, I didn’t read all 4,000 plus pages, that is what Ctrl-F is for, searching the bill for keywords that could be relevant to ecommerce and marketplaces.

Note: I am highlighting the important parts, there are small nuances in the bill that can be important in some situations, that are not included in this summary.

Also, the language in the bill continually refers to High-Volume Sellers. The bill defines such sellers as having at least 200 or more discrete transactions, totaling $5,000 or more in gross revenues over any continuous 12-month period during the previous 24 months.

So, let’s take a look at the 20 pages and how it will change online marketplaces in the US.

- High-volume sellers will have to provide the online marketplace with a bank account number, or if the seller does not have a bank account, “the name of the payee for payments issued by the online marketplace to such seller.”

- Individuals that are high-volume sellers will only need to provide their name. However, sellers that are not individuals (businesses) must provide a valid personal government ID on behalf of the seller (business) or provide a valid government-issued record or tax document that includes the business name and physical address.

- In addition, high-volume sellers will need to provide a valid Taxpayer Identification Number (TIN), working email and phone number.

- Marketplaces will have to periodically (at least once per year) request high-volume sellers to confirm and certify the information is accurate within 10 days of receiving notice. If the seller does not respond within 10 days, marketplaces may offer an additional 10 days for the seller to respond to the notice but will have to suspend all sales activities by the seller if there is no response after the second deadline. In simpler terms, once you receive the notice, you have 20 days to update or certify the contact information is correct, otherwise, your selling account has to be suspended.

- Sellers with more than $20,000 in annual gross revenues will have their contact information displayed on each listing OR in an order confirmation message or document after the purchase. This information includes:

- The full name of the individual seller or company name

- The physical address of the seller

- Contact information for direct and unhindered communication between seller and buyer, which can be an email address, phone number, or a platform-provided messaging system.

- There are exceptions to the contact disclosure requirement if the seller does not have a dedicated business address. That means sellers that only operate out of their residential home address or have a shared residential/business address will only have their country and state (if applicable) disclosed. However, shoppers will be informed that no business address exists for this seller and the only communication available between the two parties will be through phone (personal numbers exempted from disclosure – again shoppers will be told), email, or the platform’s messaging system.

- Business sellers with residential addresses that accept returns at that address may have their return addresses disclosed for product returns.

- There is also a new reporting requirement that marketplaces must make available on each high-volume seller listing to report suspicious marketplace activity. But most marketplaces already have such a feature.

- Effective Date: “This section shall take effect 180 days after the date of the enactment of this Act.” In other words, sometime in late May of 2023.

Final Words on INFORM Act

Bills like these are a bear to read. I read sections over and over to ensure the ‘simplified’ summarization is accurate and includes information applicable to most sellers. But you can read the entire INFORM Act section here (the 20 relevant pages from the spending bill).

I believe this is the language eBay said the company and other industry stakeholders and consumer groups supported earlier in the year.

The INFORM Act disclosure requirements are different from the UK example above (as well as those by other countries), with revealing contact information on listing pages not being a requirement but one of the options.

I find it somewhat confusing that there are effectively two types of high-volume sellers, those with sales over $5,000 and those with sales over $20,000. Why not just agree on one?

In addition, there may be a third definition of high-volume sellers if the last-minute proposed 1099-K amendment changing the IRS reporting requirement to $10,000 makes it into the final spending bill.

But the bottom line is that if this spending bill passes as published, and if the 1099-K amendment makes it into the final spending bill, private and micro business sellers with annual revenues of less than $5,000 won’t see much of a difference. That will be a relief to many.

If you liked this article and would like to engage with other small business entrepreneurs selling on marketplaces, join our [the_ad id=”41560″ inline =”1″]. You can also find us on [the_ad id=”41579″ inline =”1″], [the_ad id=”41573″ inline =”1″], [the_ad id=”41575″ inline =”1″], and [the_ad id=”41577″ inline =”1″] or sign up for our newsletter below.

SIGN UP. BE INSPIRED. GROW YOUR BUSINESS.

We do not sell your information. You can unsubscribe at any time.

Richard Meldner

Richard is co-founder of eSeller365. He has over 17 years of experience on eBay which includes tens of thousands of sales to buyers in over 100 countries and even has experience with eBay’s VeRO program enforcing intellectual property rights for a former employer. And for about two years Richard sold products on Amazon using Amazon FBA in the US.

To “relax” from the daily business grind, for a few weekends a year, he also works for IMSA as a professional race official.

As an American, I was angered by the increase in box store looting, but if those same stores have bought Congress and turned on the small home based businessman who is just trying to survive then I hope the looting spirals completely out of control until it destroys the box stores. You can tell our Congress is corrupt by the way they slipped this nonsense into the bill.

As a small business owner, ebay seller, the problem I have with putting my phone number on each listing is the possibility that buyers would try contacting over the phone rather than through ebay messaging, and my phone constantly ringing off the hook. I don’t have employees taking phone calls. To me, this new law looks like plain harassment of home based businesses.

There are exemptions built into the law if you don’t have a separate business number or address. That was one of the main changes to this final text versus the draft. You can also get a free phone number from Google Voice, set it to “do not disturb,” meaning it will go to voice mail all the time if you think there is a value in keeping a public number for your business but don’t want it to ring your personal phone all the time.

Richard